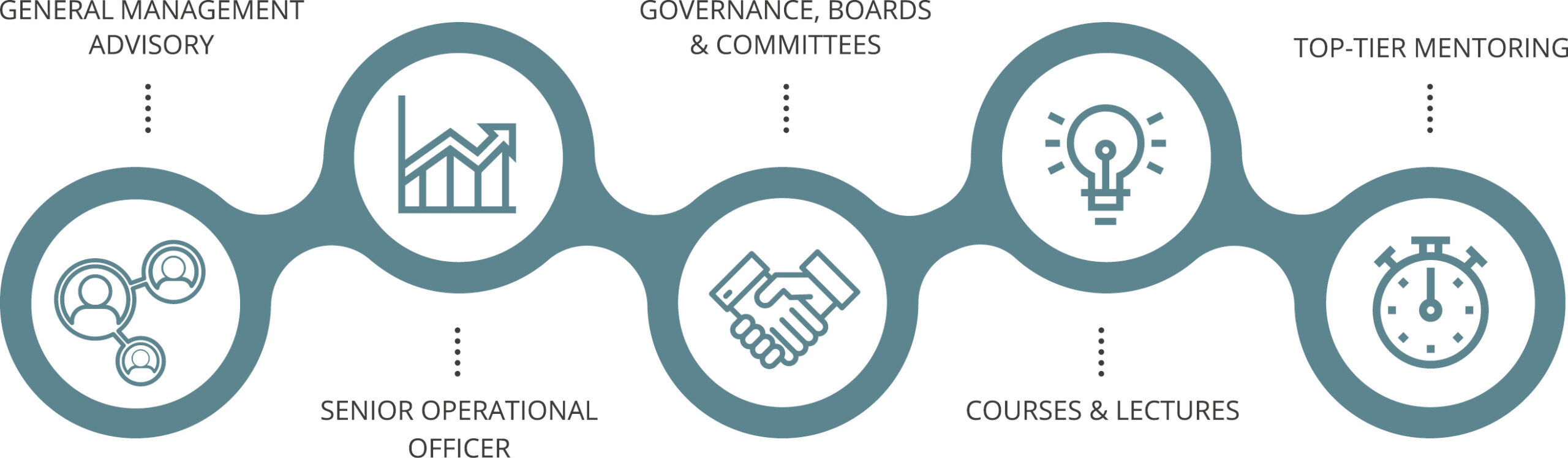

QUADRIVIUM Corporate Advisory was conceived as a platform for the association of experienced professionals with a focus on high-level advisory for leadership, governance and corporate management; participation in boards of directors and advisory committees in the areas of Strategy, Planning, Finance and Audit; assumption of executive mandate (SOE) in governance and executive boards; talent development; and ‘mentoring’ of governance agents and first tier’ officers, in companies of diverse cultures and business models, where the challenges are fuel for the enthusiasm with which we engage in a loyal, constructive and supportive way.

Emilio Carazzai

My professional experiences and academic background are eclectic. I began my career at a prestigious environmental engineering firm, AcquaPlan, where I worked in multidisciplinary teams as a member of the operational research department. With a degree in Law, my role focused on institutional analysis. During this phase, I received mentorship for seven years from an electrical engineer, a true polymath who shaped my career, notably through the consolidation of moral values, a love for the history of mathematics, language learning and self education methodology. I took several standalone university courses, mainly in operational research disciplines (Graph Theory; Linear and Stochastic Programming; and General Systems Theory).

Subsequently, I assumed the presidency of a foundation under the State Planning Secretary, taking the first steps in the twelve years during which I intermittently held positions in state and federal public administration—as State Secretary of Agriculture, Executive Secretary of the Ministry of Agriculture and the Ministry of Finance, and finally as President and Board Vice-President of Caixa Econômica Federal (1999 to 2003). Over fifteen years of my professional career were dedicated to statutory positions in banks (Banorte, Caixa, Pine, and Modal). I served as a Principal for five years at Booz Allen Hamilton, then the largest strategy and general management consulting firm in Brazil. At Booz Allen, I coordinated projects supporting the restructuring and IPO of Bompreço Supermarkets, subsequently assuming the leadership of holding company BompreçoPAR; and the organizational restructuring of the Commercial Department of the Ministry of Foreign Affairs, among others.

At a certain point, I took a sabbatical. I paused the operational phase of my executive career to pursue a master’s degree in Business Administration at Manchester Business School (England), which I completed with the approval of the thesis “The Internationalisation of the Financial Market and its Impact on Direct and Indirect Investment in Brazil” (1990).

As President of CAIXA, I found a conducive environment for exceptional initiatives. We created the banking correspondent system, starting with lottery outlets; CAIXA AQUI, to install electronic terminals in private business stores (in all Brazilian municipalities); we created an electronic card-operated account to transfer public policies’ benefits to mothers; implemented Bolsa Escola, Bolsa Saúde, and Auxílio Gás programs; instituted electronic auctions for the sale of Mortgage Bonds; sold the equity control of Caixa Seguros.

With support from the Secretary of Treasury and the Central Bank, we created Emgea, which allowed for the complete asset restructuring of CAIXA; implemented a brand new intelligent credit analysis platform; developed new housing programs during a period of tight credit constraints; shifted the focus of sports support by allocating resources to athletic modalities; and applied a complete overhaul on both the infrastructure and activities of the entity’ cultural program.

As Chief Financial Officer of Editora Abril, I led the financial restructuring completed in 2005. As CEO of Banco Pine, I led the first IPO of a medium-sized Brazilian bank, and subsequently, at the helm of Medial Saúde, I led the operational restructuring that enabled its sale out to Amil.

Then, I was a partner, advisor, and statutory director of HabitaSec Securitizadora for ten years. During that period, I became deeply involved in the corporate governance ecosystem, participating in the IBGC – Brazilian Institute of Corporate Governance as a Board member, Chairman of the Board, coordinator and member of the Finance and Strategy committees, author of publications, instructor, and representative on the Self-Regulation Council of FIP/FIEE of ANBIMA, and the Advisory Chamber of Issuing and Structuring Companies of B3 (both discontinued).

In parallel, and for most of the entire time as a top-tier corporate executive, I served on boards of directors and advisory committees of large companies and institutions: Pottencial Seguros, Terra Santa, GranBio, VIX Logística, HabitaSec, Brennand Cimentos, MDL Incorporadora, Banco Modal, Banco Pine, CAIXA, Caixa Seguros, Cibrasec, Banco do Brasil, Mastercard (Latam), Klabin Segall Incorporadora, Drogacenter, Bompreço (Royal Ahold), Proex, CHESF, Sudene, TecBan, among others.

Currently, I’m focusing on general management advisory, corporate board & committee membership, interim executive mandate, structured short courses & lectures, and mentoring for leaders at the top-tier level.

Areas of Expertise